For seniors looking for a new venture, house flipping offers a compelling blend of creativity…

If you’re thinking about buying a home, improving your credit score before you apply for a home loan is a good idea. Lenders will pull your financial history when evaluating your credit worthiness, so it’s smart to pull your own report first, before you find your dream home.

As you begin the process of improving your credit score, keep in mind that it will not be a quick process. Remember that it takes time to build a credit history and it will take time to repair it, too. Take time now to review your credit history and follow these quick tips for improving your credit score.

Review your credit report for accuracy

Request a credit report from each of the three credit reporting agencies. They will each send you one free report per year. If you are thinking of buying a home in the very near future, pull your reports and review them immediately for errors. Go over each report with a fine-tooth comb to make sure the information reported is accurate. Things to look for include verifying your personal information is correct, including your name, date of birth, and social security number. Additionally, confirm that your current accounts are accurately reported, and that resolved accounts are reflected accurately. It’s also incredibly important to confirm that you recognize every entry on your report. Make sure that everything on the report is yours and if it’s not, dispute the debt with all three agencies. Once the disputed debt is removed, you may see your credit score improve quickly.

Make a plan for improving your credit score

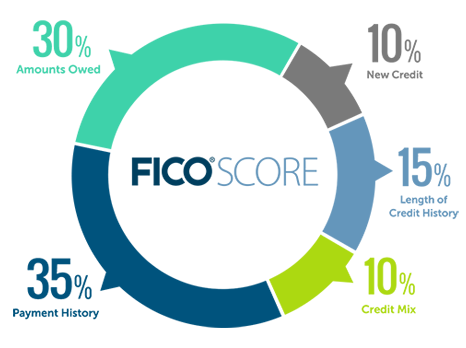

If your report shows late payments, clean them up. Try to bring all your bills current, and then get organized. Start by making sure that you’re scheduling payment due dates around your payroll schedule. Set up revolving payments when you can and then make sure that funds are available to cover the payments when they’re due. If you have collection accounts on your report, contact the collector listed on your report and ask if they will stop reporting the debt if you make payment in full. If they agree, make sure that you get their agreement in writing before making the payment. Check your report for old information. Federal laws limit the amount of time that bankruptcies and foreclosures can impact your credit.

Eliminate nuisance credit card balances

If you have balances on a number of credit cards, consider paying them off and using only one or two cards for your purchases. Paying down credit card debt will help in improving your credit score. The credit history of using and paying revolving credit balances adds to your credit age, and the stronger that payment history, the better it reflects on your credit score.

Pay all your bills on time

The largest ingredient in your credit report is your every day, month-to-month management of paying bills. That means all bills. Utilities, mortgages, car payments, credit cards, everything, including library dues! If you’re planning to save for a large purchase, don’t let yourself fall behind on small bills. Those monthly bills are the meat and potatoes of your credit and improving your credit score means staying on top of them all.

It’s going to take time to take control of your finances, and it’s not going to always be easy. Improving your credit score starts with finding out what’s in your report and then reigning in control. Focus on your spending habits like a laser and in good time, your credit score will pay you back with favorable opportunities.