For seniors looking for a new venture, house flipping offers a compelling blend of creativity…

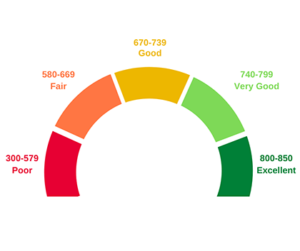

You can boost your credit score, no matter your present financial situation. If your credit score is Good (670-739) to Excellent (800-850), you can snap up almost any home you want at the lowest interest rates, provided your income level allows you to cover your monthly mortgage.

If your credit score is Poor (300-579) to Fair (580-669), you have room for much improvement and can do it much faster than you probably think. Think about that Poor category compared to the other levels on the Credit Score Ranges. There’s a 279-point range there, but only a 119-point range in the Fair category.

You might feel that you’re going to have to crawl out of an awfully big hole to improve your credit score, and you’re not wrong. Once you make it, though, you’re only 119 points away from a Good credit score!

It’s easy to be discouraged and overwhelmed with thoughts on how to punch up your credit score, but we think it’s easier than you think. Yes, it might take some time, but probably not as much as you think.

Perspective is crucial and a positive attitude will serve you well.

First Things First

More than any other factor, your credit score determines how a mortgage lender will look at your qualifications for a loan. Simply put, the higher your credit score, the lower the interest rate for your mortgage loan, and a lower interest rate translates to a lower monthly mortgage payment. That allows you more spending power every month and can mean thousands of dollars in savings over the life of your loan.

The Biggest Factor Influencing Your Credit Score

Your payment history carries the biggest weight in your credit score. If you do nothing else to reign in your credit score, make sure to pay all your bills on time, every month. If you have a lot of credit card debt, pay at least the minimum payment on time. If you have extra cash on hand, pay extra on your card until it’s paid off or down to less than 30% of your credit limit. If you’re struggling to pay off a credit card, pay on it more than once a month. There’s no rule saying you can’t pay multiple times a month. It doesn’t matter how you do it, as long as you pay on time every time and try your best to knock down your balances.

Is it going to be uncomfortable? Maybe. Can you do it? Absolutely! It’s all up to you and what you want. You can probably get a home loan today with your current score, and that’s ok! At issue is that you can get a better home in a better neighborhood for a much better monthly payment if you’re willing to put in some hard work and exercise a little patience and some restraint.

Take Control Of Your Credit Score

Pull your credit report at Annual Credit Report. (it’s free!) Your first job is to ensure it’s correct. Did you pay off a bill but it still shows on your credit report? Call the creditor and politely ask them to remove the listing. You may have to show proof, so be prepared to follow the creditor’s instructions carefully.

After you’ve ensured there are no errors, start reviewing your credit usage. Do you have a lot of credit cards? Can you pay them off or at least put a big dent in the balance? Start with the card with the lowest balance and pay it off as soon as you can. Oh, and cancel that card once it’s paid off. This reduces your credit usage and it bulks up your payment history, too.

If you have many credit cards or other revolving lines of credit, and you can swing it, consider a personal loan. This helps your total score, too, but you must remember to close some of those credit cards you just paid off. Banks consider a credit card with no balance a “loaded gun” because it can be used at any time and that can affect their consideration of your creditworthiness.

Being mindful of your credit usage puts you in the driver’s seat when it comes to your finances. No one said that any of this would be easy, but if you can soldier through a little discomfort now, we promise you’ll be rewarded with a better credit score.

Do you really need that latte every day? Think about how much you can save every month by making your own at home and taking it with you. Now, think about how fast you can improve your credit score by using that money to pay down a credit card. You could improve your total credit score by as much as 100 points within a couple of months if you start buckling down today.

The Bottom Line

Improving your credit score before you apply for a home loan is a good idea. Lenders pull your financial history when evaluating your creditworthiness, so why not do it before they do and see where you can make improvements?

At Property Conversions, we talk about your credit score and its impact on your ability to purchase a home and we hope that you’ve found our advice helpful and actionable. The truth is that a low credit score may not keep you from buying a home, but it’s likely to limit how much home you can afford to purchase as well as increase the amount that you pay for that home.

In real-world terms, yes you can probably buy a house now, but it’s going to cost you a lot more than if you take the time to improve your spending habit. Your goal is to increase your credit score and we know you can do it.

It won’t be a quick process, but slow and steady will win this race. It took time to build your credit history and it will take time to repair it, too. Make some time to review your credit history and follow these quick tips for improving your credit score.